Income tax – an Introduction

|

“It was only for the good of his subjects that he collected taxes from them, just as the Sun draws moisture from the Earth to give it back a thousand-fold” – Kalidas |

Income tax is more than a revenue tool – it fuels the spirit and strength of a prosperous and stable nation. Weaving society and opportunity for all, it represents the collective ambitions of a country.

A tax levied by the Government on the income earned by individuals and businesses in a financial year, Income Tax in India is governed by the Income Tax Act, 1961. The term ‘Income’ covers various sources, defined broadly under Section 2(24) of the Income Tax Act.

Background

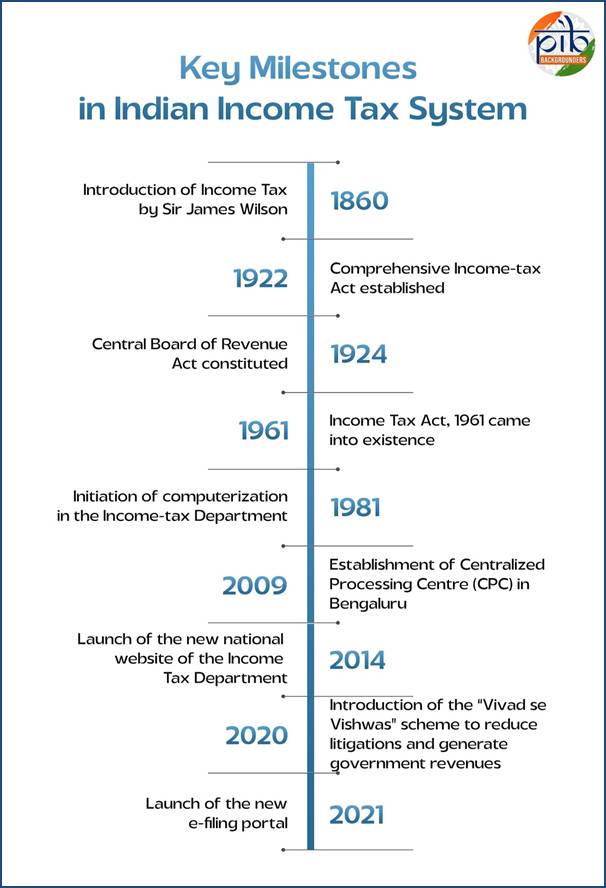

Income Tax Day is celebrated on 24th July to mark a significant milestone in India’s financial history. On this day in 1860, income tax was introduced in India by Sir James Wilson. It laid the groundwork for the Income-tax Act of 1922 that in true sense established a structured tax system which formalized various income tax authorities and also laid the foundation for a systematic administration framework.

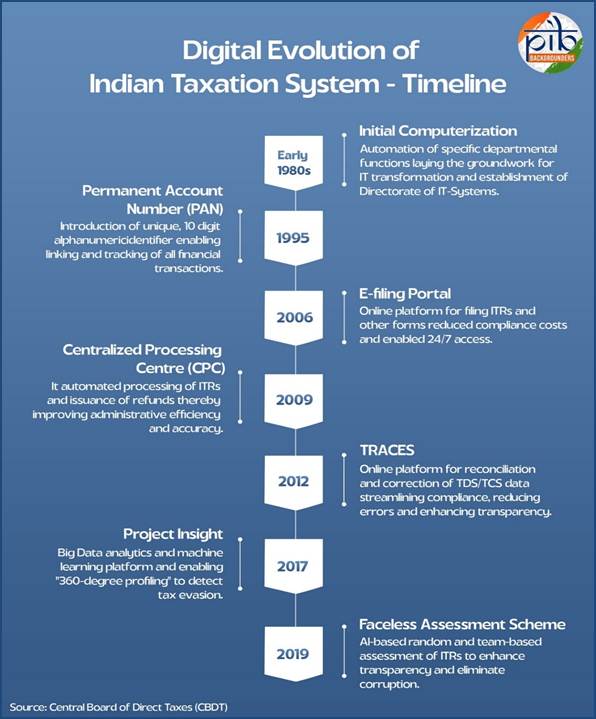

Further, the Indian taxation structure was strengthened by the Central Board of Revenue Act (1924) which established a statutory body to administer the Income-tax Act. Introduction of computerization in 1981 marked major technological upgradation, beginning with electronic processing of tax challans. By 2009, the Centralized Processing Centre (CPC) was set up in Bengaluru to handle bulk tax returns. The CPC operates in a jurisdiction-free, tech-driven manner, marking a major modernization milestone.

This Day commemorates the evolution of India’s tax administration and showcases the government’s ongoing efforts to build a streamlined and citizen-centric system.

Importance of Income Tax

- Income tax goes beyond finance—it’s pivotal for constructing stable, equitable, and self-sustaining societies.

- Income tax funds crucial services like healthcare, education, infrastructure, and national security that support societal well-being.

- Tax revenue enables government investments in various sectors, fostering growth and creating jobs.

- Taxation balances wealth accumulation and redistribution, promoting fairness and social cohesion.

- It builds state capacity and reinforces the social contract, increasing accountability between citizens and the government.

- Tax reforms help shape policies that reflect public needs, strengthening legitimacy and trust in institutions.

Income Tax Returns

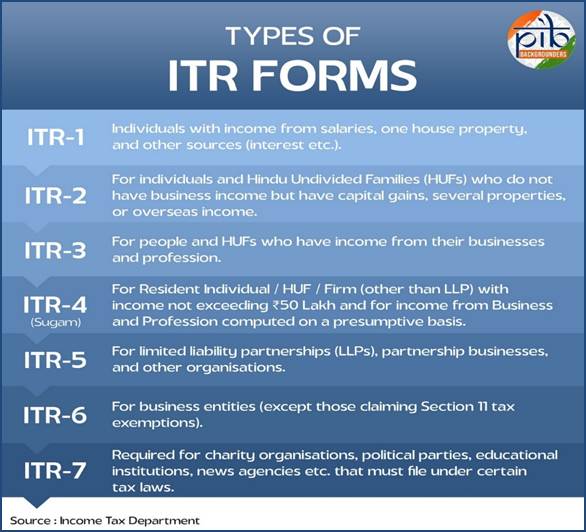

An Income Tax Return (ITR) is a form primarily used for filing details about an individual’s income and the applicable tax to the Income Tax Department. It has to be filed by every individual and business earning an income for each financial year. It helps in determining taxable income, tax liability and tax deduction claims.

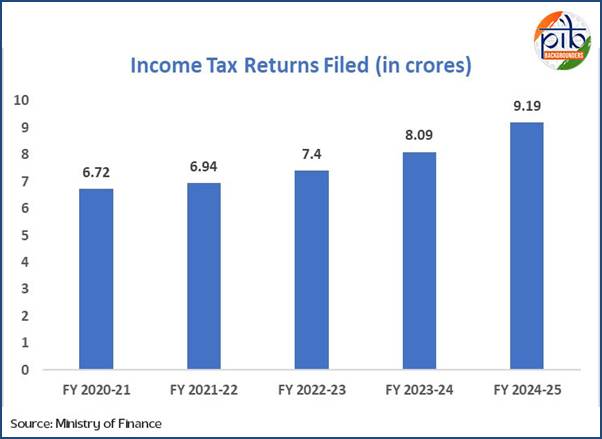

The number of Income tax returns filed has seen a rise of 36% in last 5 years with around 9.19 crore ITRs filed (including updated returns) in FY 2024-25 compared to 6.72 crores in FY 2020-21. This consistent growth reflects expanding tax payer base and voluntary compliance.

Contribution towards Nation building

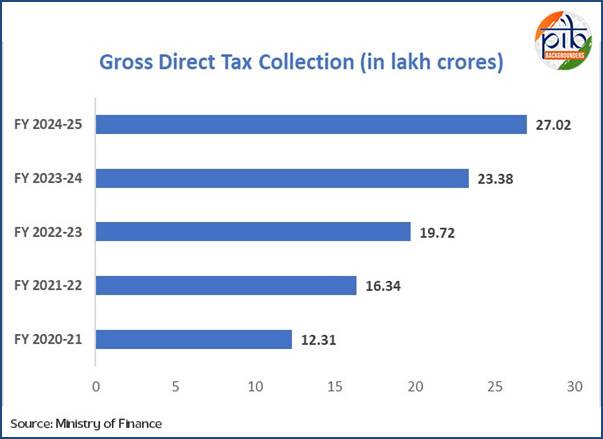

The total Gross Direct Tax Collections (before adjusting for refunds) have seen vibrant growth over the years showcasing economic stability and improved tax compliance. Figures show that the total Gross Direct Tax Collection has more than doubled in last 5 years.

For financial year 2020-21, though impacted by Covid pandemic, the total Gross Direct Tax Collection stood at Rs. 12.31 lakh crores which rose to Rs. 16.34 lakh crore in financial year 2021-22.

The trend continued in 2022-23 and 2023-24 as well, with amount reaching ₹19.72 lakh crore and Rs. 23.38 lakh crore respectively. This growth stems from a combination of economic recovery and improved efficiency in tax collection.

By FY 2024-25, the total Gross Direct Tax Collections climbed to remarkable figures of Rs. 27.02 lakh crores (provisional, as on March 31, 2025). This significant rise reflects the strength of the Indian economy combined with improved taxpayer compliance and the government’s actions to expand the tax base.

The leap to Digital Transformation

The Indian tax ecosystem has witnessed remarkable growth through various technology-driven initiatives in a phased manner. This has enabled the tax administration and taxpayers alike to meet their respective duties. The introduction of Permanent Account Number (PAN) in 1972 to initial computerization in 1981 through establishment of Directorate of Income Tax-Systems (DIT-S) laid the foundation for information technology framework. The current series of PAN (10 digit alphanumeric) was launched in 1995 offering advantages like unique identification, information matching leading to widening of tax base. Linking of PAN with AADHAR was undertaken in 2017 to improve compliance and eliminate duplication.

Further, in recent years, initiatives like setting up of Centralized Processing Centre (CPC) in 2009 and TDS Reconciliation Analysis and Correction Enabling System (TRACES) in 2012 lead to automated processing of ITRs and issuance of refunds and resolving mismatch of Tax Deducted at Source (TDS) respectively.

With Tax Information Network (TIN) the Income Tax Department (ITD) has gone beyond mere convenience to ensure that taxpayers have a plethora of options when it comes to tax payment. The introduction of TIN 2.0, a new tax payment platform, has been a trendsetter. With multiple payment modes, real-time credit of taxes, and faster processing of refunds, the department has not just streamlined the process but empowered taxpayers with greater flexibility and convenience.

With the establishment of the Demand Facilitation Centre at Mysuru, a central repository for outstanding demand has been created which is a single reference point for both the taxpayer as well as the departmental officer. Through dedicated help desks and toll-free numbers, the department has provided a life-line to taxpayers to seek clarification and reasons for the demand raised against him. The initiative has ensured that taxpayers feel supported and valued.

In last decade, focusing on global technological revolutions, the Income Tax department (ITD) launched PROJECT INSIGHT building an integrated data repository creating a “360-degree profile” of each taxpayer. This Data Warehousing and Business Intelligence platform represents a paradigm shift in how the department leverages data analytics for improving compliance and widening the tax base. By integrating data from various internal and external sources (including data exchange partners such as GSTN), the department has been able to identify cases of potential tax evasion and promote voluntary compliance among taxpayers.

Further, the Faceless Assessment Scheme launched in 2019 targets to enhance transparency, efficiency, and accountability by eliminating the physical interface between the taxpayer (Assessee) and the tax officer (Assessing Officer) through features like Automated Random Allocation and Electronic Communication.

The Annual Information Statement (AIS) was implemented on the Compliance Portal of Income-tax website on November 2021 which provides taxpayer’s financial activities across the financial year, including records related to Tax Deducted at Source (TDS), Tax Collected at Source (TCS), stock market transactions, mutual fund investments, and other relevant financial data. The Annual Information System (AIS) has revolutionized the tax administration with its non-intrusive feature focusing on convenience and transparency. The platform provides a comprehensive view of information for a taxpayer available with the department. By leveraging data from verified third parties like banks, financial institutions, property registries and brokers, AIS pre-fills tax returns, it facilitates tax payers in filing their returns and saves their time and minimizes errors. This pre-filled information fosters self-compliance, as discrepancies between declared income and third-party data prompt reconciliation. This transparency also acts as a gentle nudge to declare income fully and accurately.

The introduction of pre-filled returns, facilitated by the Annual Information Statement (AIS) and Taxpayer Information Summaries (TIS) facilitates filing returns by the taxpayers, significantly reducing errors and saving their time. The data analytical models de-duplicate, cross-check, and prepopulate returns facilitating ease of filing returns. Taxpayers can view, verify, and provide feedback or corrections on their financial data through AIS, improving accuracy and enabling voluntary compliance. Further the e-Verification Scheme offers a completely digital mechanism for resolving mismatches, allowing taxpayers to respond electronically and eliminate physical interactions.

NUDGE (Non-Intrusive Usage of Data to Guide and Enable) Taxpayers Campaigns

Income Tax Department has adopted the philosophy of ‘Trust First and Scrutinize Later’. Under this philosophy, nudge theory as discussed below becomes much more important and effective. Income Tax Department receives financial data in addition to the data contained in the returns filed by the taxpayers with the department, which can be utilized with help of ground level intelligence, findings of search and seizure actions, coupled with the patterns to be identified with help of data analytics, to identify tax evasion patterns or misuse of provisions of the Act.

NUDGE stands for Non-Intrusive Usage of Data to Guide and Enable Taxpayers, which is based on nudge theory, based in behavioural economics and psychology that refers to a subtle suggestion or influence or intervention that can change behaviour of individuals in a predictable way without limiting their freedom of choice. It is appreciated that most taxpayers are inherently honest, and they should be rewarded for their honesty and scrutiny, or any invasive action, should be undertaken only as a last resort.

Section 139(8A) inserted by Finance Act, 2022 permits taxpayers to file an updated I-T return within 24 months from the end of the relevant assessment year w.e.f. 1st April 2022. The provision has been amended by Finance Act, 2025 to extend the time-limit to file the updated return from 24 months to 48 months from the end of the relevant assessment year. This amendment provides opportunity to the taxpayer to correct the mistakes in the originally filed

returns with payment of additional tax but without any penal liability. The department with the use of digital infrastructure nudges the taxpayers who are suspected to have made wrong claims of deductions and exemptions in their returns and encourages them to update their returns and pay correct amount of tax.

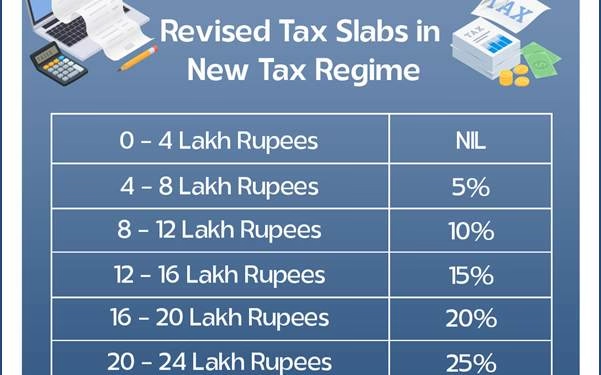

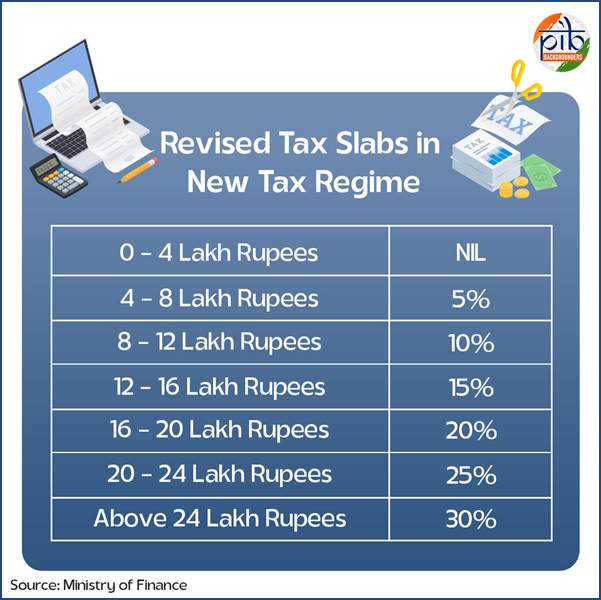

Budget 2025-26: Income Tax Slab Changes

Several relief measures have been provided for the tax-payers in the Union Budget for 2025-26 reaffirming the Government’s growth-based approach. The new tax structure provides for no income tax up to income of Rs. 12 lakhs as per the new regime. The salaried tax payer will be paying NIL tax for income not exceeding Rs. 12.75 lakh after availing the benefit of the Standard Deduction of Rs. 75,000. The tax rebate has been combined with the benefit from

the reduction in the slab rate resulting in no tax liability. This initiative will increase the household consumption, expenditure and investments particularly for middle class.

Other Notable Initiatives

Various initiatives have been taken by the Union Government to increase tax collection and suppressing tax evasion, cultivating tax compliance.

Rationalization of TDS/TCS

Ø Limit of tax deduction on interest for Senior Citizens doubled from Rs. 50,000 to Rs. 1 lakh.

Ø TDS limit on rent increased from Rs. 2.4 lakh to Rs. 6 lakh per annum.

Ø Threshold to collect tax at source (TCS) on foreign remittances under the Liberalized Remittance Scheme (LRS) increased to Rs. 10 lakhs from Rs. 7 lakhs.

Ø Decriminalization of delay in TCS payments.

Promoting Voluntary Compliance

Ø Withdrawals on or after August 29, 2024 from National Savings Scheme (NSS) accounts are now fully tax-exempt for individuals.

Ø Tax deduction for National Pension Scheme (NPS) Vatsalya accounts under the old regime.

Simplifying Compliance

Ø The time-limit to file updated returns increased from 2 years to 4 years.

Ø Increasing period of registration for small charitable trusts/ institutions from 5 years to 10 years.

Ø Annual value of 2 self-occupied properties (previously 1) allowed without any conditions.

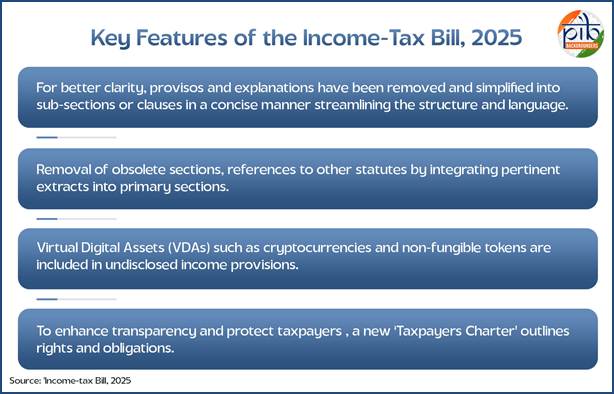

Income Tax Bill, 2025 – Pathway to Indian Tax Reforms

The Income Tax Bill, 2025 seeks to replace the existing Income Tax Act, 1961 which has seen multiple amendments over the years. It retains basic tax provisions of the existing act and primarily aims to simplify the language and remove redundant provisions. This marks an important step towards Viksit Bharat by enhancing clarity which makes it easier to understand and removes ambiguities.

Conclusion

Income Tax Day stands as a tribute to India’s enduring commitment to build a robust and inclusive taxation system. From the establishment of the Central Board of Revenue in 1924 to the tech-forward transformation marked by ongoing digital governance initiatives, the journey reflects a legacy of reform, resilience, and modernization. This day honours not only the people behind tax collection, but also the tax payers and the foundational role income tax plays in funding public services, driving economic progress, and reinforcing social equity. It reminds us that a transparent, efficient, and citizen-friendly tax ecosystem is essential for a strong and self-sustaining democracy. Looking forward, the historical legacy and the current measures will contribute to a stable and strong economic structure driving towards prosperity.References:

INCOME TAX BILL, 2025

PARLIAMENT OF INDIA