Mumbai, January 1, 2026

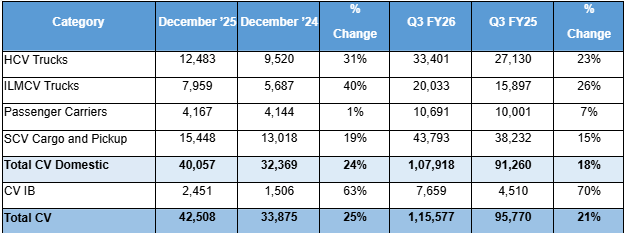

Q3FY25 sales in the domestic & international markets stood at 1,15,577 units, compared to 95,770 units during Q3FY25. December 2025 sales in the domestic & international markets stood at 42,508 units, compared to 33,875 units during December 2024.

- Domestic sales of MH&ICV in December 2025 was 20,363 units vs 15,968 units in December 2024; In Q3FY26 it was 53,105 units, compared to 44,023 units in Q3FY25

- Domestic & International sales for MH&ICV in December 2025 was 21,646 units vs 16,604 units in December 2024; In Q3FY26 it was 57,080 units, compared to 46,108 units in Q3FY25.

Mr. Girish Wagh, MD & CEO, Tata Motors Ltd., said, “The sales momentum ignited by GST 2.0 and the festive surge in Q2FY26 continued into Q3FY26, driving growth and lifting overall sentiment of the commercial vehicles industry.

Tata Motors registered double-digit sales growth in Q3FY26, powered by a strong rebound in construction and mining activity post the extended monsoon, along with sustained demand from core sectors and auto logistics. Continued strength in SCVs and Pickups further amplified performance, resulting in wholesales of 1,15,577 units, with 21% year-on-year growth over Q3FY25 and 22% sequential growth over Q2FY26.

Going forward, we expect demand to strengthen in Q4FY26 across most commercial vehicle segments. Key drivers in 2026 will include the government’s sustained infrastructure push and expansion in end-use sectors, both of which are expected to fuel positive momentum for the industry. With an optimised portfolio ensuring superior product availability, a decisive pricing strategy, and deeper customer engagement through intensified market activations, Tata Motors is well-poised to unlock demand across segments, paving the way for continued success.”