SUMMARY OF UNION BUDGET 2025-26

Posted On: 01 FEB 2025 1:31PM by PIB Delhi

NO INCOME TAX ON AVERAGE MONTHLY INCOME OF UPTO RS 1 LAKH; TO BOOST MIDDLE CLASS HOUSEHOLD SAVINGS & CONSUMPTION

SALARIED CLASS TO PAY NIL INCOME TAX UPTO ₹ 12.75 LAKH PER ANNUM IN NEW TAX REGIME

UNION BUDGET RECOGNISES 4 ENGINES OF DEVELOPMENT – AGRICULTURE, MSME, INVESTMENT AND EXPORTS

BENEFITTING 1.7 CRORE FARMERS, ‘PRIME MINISTER DHAN-DHAANYA KRISHI YOJANA’ TO COVER 100 LOW AGRICULTURAL PRODUCTIVITY DISTRICTS

“MISSION FOR AATMANIRBHARTA IN PULSES” WITH A SPECIAL FOCUS ON TUR, URAD AND MASOOR TO BE LAUNCHED

LOANS UPTO Rs. 5 LAKHS THROUGH KCC UNDER MODIFIED INTEREST SUBVENTION SCHEME

FY-25 ESTIMATED TO END WITH FISCAL DEFICIT OF 4.8%, TARGET TO BRING IT DOWN TO 4.4% IN FY-26

SIGNIFICANT ENHANCEMENT OF CREDIT WITH GUARANTEE COVER TO MSMEs FROM ₹ 5 CR TO ₹ 10 CR

A NATIONAL MANUFACTURING MISSION COVERING SMALL, MEDIUM AND LARGE INDUSTRIES FOR FURTHERING “MAKE IN INDIA”

50,000 ATAL TINKERING LABS IN GOVERNMENT SCHOOLS IN NEXT 5 YEARS

CENTRE OF EXCELLENCE IN ARTIFICIAL INTELLIGENCE FOR EDUCATION, WITH A TOTAL OUTLAY OF ₹ 500 CRORE

PM SVANIDHI WITH ENHANCED LOANS FROM BANKS, AND UPI LINKED CREDIT CARDS WITH ₹ 30,000 LIMIT

GIG WORKERS TO GET IDENTITY CARDS, REGISTRATION ON E-SHRAM PORTAL & HEALTHCARE UNDER PM JAN AROGYA YOJANA

₹ 1 LAKH CRORE URBAN CHALLENGE FUND FOR ‘CITIES AS GROWTH HUBS’

NUCLEAR ENERGY MISSION FOR R&D OF SMALL MODULAR REACTORS WITH AN OUTLAY OF ₹ 20,000 CRORE

MODIFIED UDAN SCHEME TO ENHANCE REGIONAL CONNECTIVITY TO 120 NEW DESTINATIONS

₹ 15,000 CRORE SWAMIH FUND TO BE ESTABLISHED FOR EXPEDITIOUS COMPLETION OF ANOTHER 1 LAKH STRESSED HOUSING UNITS

₹ 20,000 CRORE ALLOCATED FOR PRIVATE SECTOR DRIVEN RESEARCH DEVELOPMENT AND INNOVATION INITIATIVES

GYAN BHARATAM MISSION FOR SURVEYAND CONSERVATION OF MANUSCRIPTS TO COVER MORE THAN ONE CRORE MANUSCRIPTS

FDI LIMIT ENHANCED FOR INSURANCE FROM 74 TO 100 PER CENT

JAN VISHWAS BILL 2.0 TO BE INTRODUCED FOR DECRIMINALISING MORE THAN 100 PROVISIONS IN VARIOUS LAWS

UPDATED INCOME TAX RETURNS TIME LIMIT INCREASED FROM TWO TO FOUR YEARS

DELAY IN TCS PAYMENT DECRIMINALISED

TDS ON RENT INCREASED FROM ₹ 2.4 LAKH TO ₹ 6 LAKH

BCD EXEMPTED ON 36 LIFESAVING DRUGS AND MEDICINES FOR TREATING CANCER, RARE AND CHRONIC DISEASES

BCD ON IFPD INCREASED TO 20% AND ON OPEN CELLS REDUCED TO 5%

BCD ON PARTS OF OPEN CELLS EXEMPTED TO PROMOTE DOMESTIC MANUFACTURING

TO BOOST BATTERY PRODUCTION, ADDITIONAL CAPITAL GOODS FOR EV AND MOBILE BATTERY MANUFACTURING EXEMPTED

BCD EXEMPTED FOR 10 YEARS ON RAW MATERIALS & COMPONENTS USED FOR SHIP BUILDING

BCD REDUCED FROM 30% TO 5% ON FROZEN FISH PASTE AND 15% TO 5% ON FISH HYDROLYSATE

Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman presented the Union Budget 2025-26 in Parliament today. Here is the summary of her budget speech;

PART A

Quoting Telugu poet and playwright Shri Gurajada Appa Rao’s famous saying, ‘A country is not just its soil; a country is its people.’ – the Finance Minister presented the Union Budget 2025-26 with the theme “Sabka Vikas” stimulating balanced growth of all regions.

In line with this theme, the Finance Minister outlined the broad Principles of Viksit Bharat to encompass the following:

- a) Zero-poverty;

- b) Hundred per cent good quality school education;

- c) Access to high-quality, affordable, and comprehensive healthcare;

- d) Hundred per cent skilled labour with meaningful employment;

- e) Seventy per cent women in economic activities; and

- f) Farmers making our country the ‘food basket of the world’.

The Union Budget 2025-2026 promises to continue Government’s efforts to accelerate growth, secure inclusive development, invigorate private sector investments, uplift household sentiments, and enhance spending power of India’s rising middle class. The Budget proposes development measures focusing on poor (Garib), Youth, farmer (Annadata) and women (Nari).

The Budget aims to initiate transformative reforms in Taxation, Power Sector, Urban Development, Mining, Financial Sector, and Regulatory Reforms to augment India’s growth potential and global competitiveness.

Union Budget highlights that Agriculture, MSME, Investment, and Exports are engines in the journey to Viksit Bharat using reforms as fuel, guided by the spirit of inclusivity.

1st Engine: Agriculture

Budget announced ‘Prime Minister Dhan-Dhaanya Krishi Yojana’ in partnership with states covering 100 districts to increase productivity, adopt crop diversification, augment post-harvest storage, improve irrigation facilities, and facilitate availability of long-term and short-term credit.

A comprehensive multi-sectoral ‘Rural Prosperity and Resilience’ programme will be launched in partnership with states to address underemployment in agriculture through skilling, investment, technology, and invigorating the rural economy. The goal is to generate ample opportunities in rural areas, with focus on rural women, young farmers, rural youth, marginal and small farmers, and landless families.

Union Finance Minister announced that Government will launch a 6-year “Mission for Aatmanirbharta in Pulses” with special focus on Tur, Urad and Masoor. Central agencies (NAFED and NCCF) will be ready to procure these 3 pulses, as much as offered during the next 4 years from farmers.

The Budget has outlined measures to Comprehensive Programme for Vegetables & Fruits, National Mission on High Yielding Seeds, and a five year Mission for Cotton Productivity amongst other measures to promote agriculture and allied activities in a major way.

Smt. Sitharaman announced the increase in loan limits from Rs. 3 lakh to Rs. 5 lakh for loans taken through Kisan Credit Cards under modified interest subvention scheme.

2nd Engine: MSMEs

Finance Minister described MSMEs as the second power engine for development as they constitute for 45% of our exports. To help MSMEs achieve higher efficiencies of scale, technological upgradation and better access to capital, the investment and turnover limits for classification of all MSMEs enhanced to 2.5 and 2 times, respectively. Further, steps to enhance credit availability with guarantee cover have also been announced.

The Finance Minister also announced the launch of a new scheme for 5 lakh women, Scheduled Castes and Scheduled Tribes first-time entrepreneurs. This will provide term loans up to Rs. 2 crore during the next 5 years.

Smt. Sitharaman announced that the Government will also implement a scheme to make India a global hub for toys representing the ‘Made in India’ brand. She added that the Government will set up a National Manufacturing Mission covering small, medium and large industries for furthering “Make in India”.

3rd Engine: Investment

Defining Investment as the third engine of growth, the Union Minister prioritized investment in people, economy and innovation.

Under the investment in people, she announced that 50,000 Atal Tinkering Labs will be set up in Government schools in next 5 years.

Smt. Nirmala Sitharaman announced that broadband connectivity will be provided to all Government secondary schools and primary health centres in rural areas under the Bharatnet project.

She said Bharatiya Bhasha Pustak Scheme will be implemented to provide digital-form Indian language books for school and higher education.

Five National Centres of Excellence for skilling will be set up with global expertise and partnerships to equip our youth with the skills required for “Make for India, Make for the World” manufacturing.

A Centre of Excellence in Artificial Intelligence for education will be set up with a total outlay of 500 crore.

Budget announced that Government will arrange for Gig workers’ identity cards, their registration on the e-Shram portal and healthcare under PM Jan Arogya Yojana.

Under the investment in Economy, Smt Sitharaman said Infrastructure-related ministries will come up with a 3-year pipeline of projects in PPP mode.

She added that an outlay of Rs 1.5 lakh crore was proposed for the 50-year interest free loans to states for capital expenditure and incentives for reforms.

She also announced the second Asset Monetization Plan 2025-30 to plough back capital of Rs 10 lakh crore in new projects.

The Jal Jeevan Mission was extended till 2028 with focus on the quality of infrastructure and Operation & Maintenance of rural piped water supply schemes through “Jan Bhagidhari”.

Government will set up an Urban Challenge Fund of Rs.1 lakh crore to implement the proposals for ‘Cities as Growth Hubs’, ‘Creative Redevelopment of Cities’ and ‘Water and Sanitation’.

Under the investment in Innovation, an allocation of ₹20,000 crore is announced to implement private sector driven Research, Development and Innovation initiative.

Finance Minister proposed National Geospatial Mission to develop foundational geospatial infrastructure and data which will benefit urban planning.

Budget proposes Gyan Bharatam Mission, for survey, documentation and conservation of more than 1 crore manuscripts with academic institutions, museums, libraries and private collectors. A National Digital Repository of Indian knowledge systems for knowledge sharing is also proposed.

4th Engine: Exports

Smt. Sitharaman defined Exports as the fourth engine of growth and said that jointly driven by the Ministries of Commerce, MSME, and Finance; Export Promotion Mission will help MSMEs tap into the export market. She added that a digital public infrastructure, ‘BharatTradeNet’ (BTN) for international trade was proposed as a unified platform for trade documentation and financing solutions.

The Finance Minister mentioned that support will be provided to develop domestic manufacturing capacities for our economy’s integration with global supply chains. She also announced that government will support the domestic electronic equipment industry for leveraging the opportunities related to Industry 4.0. A National Framework has also been proposed for promoting Global Capability Centres in emerging tier 2 cities.

The government will facilitate upgradation of infrastructure and warehousing for air cargo including high value perishable horticulture produce.

Reforms as the Fuel

Defining Reforms as the fuel to the engine, Smt. Sitharaman said that over the past 10 years, the Government had implemented several reforms for convenience of tax payers, such as faceless assessment, tax payers charter, faster returns, almost 99 per cent returns being on self-assessment, and Vivad se Vishwas scheme. Continuing with these efforts, she reaffirmed the commitment of the tax department to “trust first, scrutinize later”.

Financial Sector Reforms and Development

In a demonstrated steadfast commitment of the Government towards ‘Ease of Doing Business’, the Union Finance Minister proposed changes across the length and breadth of the financial landscape in India to ease compliance, expand services, build strong regulatory environment, promote international and domestic investment, and decriminalisation of archaic legal provisions.

The Union Finance Minister proposed to raise the Foreign Direct Investment (FDI) limit for the insurance from 74 to 100 per cent, to be available for those companies that invest the entire premium in India.

Smt. Sitharaman proposed a light-touch regulatory framework based on principles and trust to unleash productivity and employment. She proposed four specific measures to develop this modern, flexible, people-friendly, and trust-based regulatory framework for the 21st first century, viz.:

- High Level Committee for Regulatory Reforms

- To review all non-financial sector regulations, certifications, licenses, and permissions.

- To strengthen trust-based economic governance and take transformational measures to enhance ‘ease of doing business’, especially in matters of inspections and compliances

- To make recommendations within a year

- States will be encouraged to be onboarded

- Investment Friendliness Index of States

- An Investment Friendliness Index of States will be launched in 2025 to further the spirit of competitive cooperative federalism.

- Mechanism under the Financial Stability and Development Council (FSDC)

- Mechanism to evaluate impact of the current financial regulations and subsidiary instructions.

- Formulate a framework to enhance their responsiveness and development of the financial sector.

- Jan Vishwas Bill 2.0

- To decriminalise more than 100 provisions in various laws.

Fiscal Consolidation

Reiterating the commitment to stay the course for fiscal consolidation, the Union Finance Minister stated that the Government endeavours to keep the fiscal deficit each year such that the Central Government debt remains on a declining path as a percentage of the GDP and the detailed roadmap for the next 6 years has been detailed in the FRBM statement. Smt. Sitharaman stated that the Revised Estimate 2024-25 of fiscal deficit is 4.8 per cent of GDP, while the Budget Estimates 2025-26 is estimated to be 4.4 per cent of GDP.

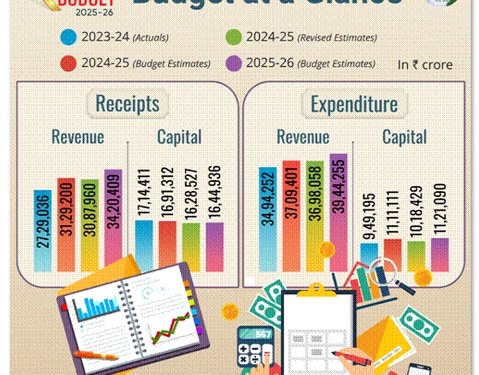

Revised Estimates 2024-25

The Minister said that the Revised Estimate of the total receipts other than borrowings is ₹31.47 lakh crore, of which the net tax receipts are ₹25.57 lakh crore. She added that the Revised Estimate of the total expenditure is ₹47.16 lakh crore, of which the capital expenditure is about ₹10.18 lakh crore.

Budget Estimates 2025-26

For FY 2025-26, the Union Finance Minister stated that the total receipts other than borrowings and the total expenditure are estimated at ₹34.96 lakh crore and ₹50.65 lakh crore respectively. The net tax receipts are estimated at ₹28.37 lakh crore.

PART B

Reposing faith on middle class in nation building, the Union Budget 2025-26 proposes new direct tax slabs and rates under the new income tax regime so that no income tax is needed to be paid for total income upto ₹ 12 Lakh per annum, i.e. average income of Rs 1 Lakh per month, other than special rate income such as Capital Gain. Salaried individuals earning upto ₹ 12.75 Lakh per annum will pay NIL tax, due to standard deduction of ₹ 75,000. Towards the new tax structure and other direct tax proposals, Government is set to lose revenue of about ₹ 1 lakh crore.

Under the guidance of Prime Minister Shri Narendra Modi, the Government has taken steps to understand the needs voiced by the people. The direct tax proposals include personal income tax reform with special focus on middle class, TDS/TCS rationalization, encouragement to voluntary compliances along with reduction of compliance burden, ease of doing business and incentivizing employment and investment.

The Budget proposes revised tax rate structure under the new tax regime as follows;

| Total Income per annum | Rate of Tax |

| ₹ 0 – 4 Lakh | NIL |

| ₹ 4 – 8 Lakh | 5% |

| ₹ 8 – 12 Lakh | 10% |

| ₹ 12 – 16 Lakh | 15% |

| ₹ 16 – 20 Lakh | 20% |

| ₹ 20 – 24 Lakh | 25% |

| Above ₹ 24 Lakh | 30% |

To rationalize TDS/TCS, Budget doubles limit for tax deduction on interest earned by senior citizens from the present ₹ 50,000 to ₹ 1 Lakh. Further, TDS threshold on rent has been increased to ₹ 6 Lakh from ₹ 2.4 Lakh per annum. Other measures include, increasing of threshold to collect TCS to ₹ 10 Lakh and continuing with higher TDS deductions only in non-PAN cases. After the decriminalization of delay in payment of TDS, delay in TCS payments has now been decriminalized.

Encouraging voluntary compliance, Budget extends time-limit to file updated returns for any assessment year, from the current limit of two years, to four years. Over 90 Lakh taxpayers paid additional tax to update their income. Small charitable trusts/institutions have been given the benefit by increasing their period of registration from 5 to 10 years, reducing compliance burden. Further, tax payers can now claim annual value of two self-occupied properties as NIL, without any condition. Last budget’s Vivad Se Vishwas Scheme has received a great response, with nearly 33,000 tax payers having availed the scheme to settle their disputes. Giving benefits to senior and very senior citizens, withdrawals made from National Savings Scheme Accounts on or after 29th of August, 2024 have been exempted. NPS Vatsalya accounts also to get similar benefits.

For ease of doing business, Budget introduces a scheme for determining arm’s length price of international transaction for a block period of three years. This is in line with global best practices. Further, self harbor rules are being expanded to provide certainty in international taxation.

To promote employment and investment, a presumptive taxation regime is envisaged for non-residents who provide services to a resident company that is establishing or operating an electronics manufacturing facility. Further, benefits of existing tonnage tax scheme are proposed to be extended to inland vessels. To promote start-up ecosystem, period of incorporation has been extended for a period of 5 years. To promote investment in the infrastructure sector, Budget extends the date of making investment in Sovereign Wealth Funds and Pension Funds by five more years, to 31st March, 2030.

As part of rationalization of Customs tariffs of industrial goods, Budget proposes to; (i) Remove seven tariffs, (ii) apply appropriate cess to maintain effective duty incidence, and (iii) levy not more than one cess or surcharge.

As relief on import of Drugs/Medicines, 36 lifesaving drugs and medicines for treating cancer, rare diseases and chronic diseases have been fully exempted from Basic Customs Duty (BCD). Further, 37 medicines along with 13 new drugs and medicines under Patient Assistance Programmes have been exempted from Basic Customs Duty (BCD), if supplied free to patients.

To support Domestic Manufacturing and Value Addition, BCD on 25 critical minerals, that were not domestically available, were exempted in July 2024. The Budget 2025-26 fully exempts cobalt powder and waste, scrap of lithium-ion battery, Lead, Zinc and 12 more critical minerals. To promote domestic textile production, two more types of shuttle-less looms added to fully exempted textile machinery. Further, BCD on knitted fabrics covering nine tariff lines from “10% to 20%” revised to “20% or ₹ 115 kg, whichever is higher”.

To rectify inverted duty structure and promote “Make in India”, BCD on Interactive Flat Panel Display (IFPD) increased to 20% and on Open cells reduced to 5%. Further to promote manufacture of Open cells, BCD on parts of Open Cells stands exempted.

To boost manufacturing of Lithion-ion battery in the country, 35 additional capital goods for EV battery manufacturing, and 28 additional capital goods for mobile phone battery manufacturing added to the list of exempted capital goods. Union Budget 2025-26 also continues exemption on BCD on raw materials, components, consumables or parts for ship building for another ten years. Budget also reduced BCD from 20% to 10% on Carrier Grade ethernet switches to make it at par with Non-Carrier Grade ethernet switches.

For export promotion, Budget 2025-26 facilitates exports of handicrafts, fully exempts BCD on Wet Blue leather for value addition and employment, reduce BCD from 30% to 5% on Frozen Fish Paste and reduce BCD from 15% to 5% on fish hydrolysate for manufacture of fish and shrimp feeds.

Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman said that Democracy, Demography and Demand are key pillars of Viksit Bharat journey. She said that the middle class gives strength of India’s growth and the Government has periodically hiked the ‘Nil tax’ slab in recognition to their contribution. She said the proposed new tax structure will substantially boost consumption, savings and investment, by putting more money in the hands of the middle class.

LIMIT TO BE Rs. 12.75 LAKH FOR SALARIED TAX PAYERS, WITH STANDARD DEDUCTION OF RS. 75,000

UNION BUDGET 2025-26 BRINGS ACROSS-THE-BOARD CHANGE IN INCOME TAX SLABS AND RATES TO BENEFIT ALL TAX-PAYERS

TAX SLAB RATE REDUCTION AND REBATES TO RESULT IN SUBSTANTIAL TAX RELIEF TO MIDDLE CLASS, THEREBY BOOSTING HOUSEHOLD CONSUMPTION EXPENDITURE AND INVESTMENT

01 FEB 2025 1:28PM by PIB Delhi

Reaffirming Government’s commitment to the philosophy of “trust first, scrutinize later”, the Union Budget 2025-26 has reposed faith in the Middle class and continued the trend of giving relief in tax burden to the common tax–payer. Presenting the Budget in the Parliament today, Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman proposed an across-the-board change in tax slabs and rates to benefit all tax-payers.

Giving the good news to tax payers, the Finance Minister stated, “There will be no income tax payable upto income of Rs. 12 lakh (i.e. average income of Rs.1 lakh per month other than special rate income such as capital gains) under the new regime. This limit will be Rs.12.75 lakh for salaried tax payers, due to standard deduction of Rs. 75,000.” Tax rebate is being provided in addition to the benefit due to slab rate reduction in such a manner that there is no tax payable by them, she added.

Smt. Sitharaman stated, “The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment”. In the new tax regime, the Finance Minister proposed to revise tax rate structure as follows:

| 0-4 lakh rupees | Nil |

| 4-8 lakh rupees | 5 per cent |

| 8-12 lakh rupees | 10 per cent |

| 12-16 lakh rupees | 15 per cent |

| 16-20 lakh rupees | 20 per cent |

| 20- 24 lakh rupees | 25 per cent |

| Above 24 lakh rupees | 30 per cent |

The total tax benefit of slab rate changes and rebate at different income levels can be illustrated in the table below:

While underlining Taxation Reforms as one of key reforms to realize the vision of Viksit Bharat, Smt. Sitharaman stated that the new income-tax bill will carry forward the spirit of ‘Nyaya’. The new regime will be simple to understand for taxpayers and tax administration, leading to tax certainty and reduced litigation, she informed.

Quoting Verse 542 from The Thirukkural, the Finance Minister stated, “Just as living beings live expecting rains, Citizens live expecting good governance.” Reforms are a means to achieve good governance for the people and economy. Providing good governance primarily involves being responsive. The tax proposals detail just how the Government under the guidance of Prime Minister Shri Narendra Modi has taken steps to understand and address the needs voiced by our citizens, Smt. Sitharaman added.

HIGHLIGHTS OF UNION BUDGET 2025-26

Posted On: 01 FEB 2025 1:29PM by PIB Delhi

PART A

Union Minister for Finance and Corporate Affairs Smt Nirmala Sitharaman presented Union Budget 2025-26 in the Parliament today. The highlights of the budget are as follows:

Budget Estimates 2025-26

- The total receipts other than borrowings and the total expenditure are estimated at ₹ 34.96 lakh crore and ₹ 50.65 lakh crore respectively.

- The net tax receipts are estimated at ₹ 28.37 lakh crore.

- The fiscal deficit is estimated to be 4.4 per cent of GDP.

- The gross market borrowings are estimated at ₹ 14.82 lakh crore.

- Capex Expenditure of ₹11.21 lakh crore (3.1% of GDP) earmarked in FY2025-26.

AGRICULTURE AS THE 1ST ENGINE OF DEVELOPMENT

Prime Minister Dhan-Dhaanya Krishi Yojana – Developing Agri Districts Programme

- The programme to be launched in partnership with the states, covering 100 districts with low productivity, moderate crop intensity and below-average credit parameters, to benefit 1.7 crore farmers.

Building Rural Prosperity and Resilience

- A comprehensive multi-sectoral programme to be launched in partnership with states to address under-employment in agriculture through skilling, investment, technology, and invigorating the rural economy.

- Phase-1 to cover 100 developing agri-districts.

Aatmanirbharta in Pulses

- Government to launch a 6-year “Mission for Aatmanirbharta in Pulses” with focus on Tur, Urad and Masoor.

- NAFED and NCCF to procure these pulses from farmers during the next 4 years.

Comprehensive Programme for Vegetables & Fruits

- A comprehensive programme to promote production, efficient supplies, processing, and remunerative prices for farmers to be launched in partnership with states.

Makhana Board in Bihar

- A Makhana Board to be established to improve production, processing, value addition, and marketing of makhana.

National Mission on High Yielding Seeds

- A National Mission on High Yielding Seeds to be launched aiming at strengthening the research ecosystem, targeted development and propagation of seeds with high yield, and commercial availability of more than 100 seed varieties.

Fisheries

- Government to bring a framework for sustainable harnessing of fisheries from Indian Exclusive Economic Zone and High Seas, with a special focus on the Andaman & Nicobar and Lakshadweep Islands.

Mission for Cotton Productivity

- A 5-year mission announced to facilitate significant improvements in productivity and sustainability of cotton farming, and promote extra-long staple cotton varieties.

Enhanced Credit through KCC

- The loan limit under the Modified Interest Subvention Scheme to be enhanced from ₹ 3 lakh to ₹ 5 lakh for loans taken through the KCC.

Urea Plant in Assam

- A plant with annual capacity of 12.7 lakh metric tons to be set up at Namrup, Assam.

MSMEs AS THE 2ND ENGINE OF DEVELOPMENT

Revision in classification criteria for MSMEs

- The investment and turnover limits for classification of all MSMEs to be enhanced to 2.5 and 2 times respectively.

Credit Cards for Micro Enterprises

- Customized Credit Cards with ₹ 5 lakh limit for micro enterprises registered on Udyam portal, 10 lakh cards to be issued in the first year.

Fund of Funds for Startups

- A new Fund of Funds, with expanded scope and a fresh contribution of ₹ 10,000 crore to be set up.

Scheme for First-time Entrepreneurs

- A new scheme for 5 lakh women, Scheduled Castes and Scheduled Tribes first-time entrepreneurs to provide term-loans upto ₹ 2 crore in the next 5 years announced.

Focus Product Scheme for Footwear & Leather Sectors

- To enhance the productivity, quality and competitiveness of India’s footwear and leather sector, a focus product scheme announced to facilitate employment for 22 lakh persons, generate turnover of ₹ 4 lakh crore and exports of over ₹ 1.1 lakh crore.

Measures for the Toy Sector

- A scheme to create high-quality, unique, innovative, and sustainable toys, making India a global hub for toys announced.

Support for Food Processing

- A National Institute of Food Technology, Entrepreneurship and Management to be set up in Bihar.

Manufacturing Mission – Furthering “Make in India”

- A National Manufacturing Mission covering small, medium and large industries for furthering “Make in India” announced.

INVESTMENT AS THE 3RD ENGINE OF DEVELOPMENT

- Investing in People

Saksham Anganwadi and Poshan 2.0

- The cost norms for the nutritional support to be enhanced appropriately.

Atal Tinkering Labs

- 50,000 Atal Tinkering Labs to be set up in Government schools in next 5 years.

Broadband Connectivity to Government Secondary Schools and PHCs

- Broadband connectivity to be provided to all Government secondary schools and primary health centres in rural areas under the Bharatnet project.

Bharatiya Bhasha Pustak Scheme

- Bharatiya Bhasha Pustak Scheme announced to provide digital-form Indian language books for school and higher education.

National Centres of Excellence for Skilling

- 5 National Centres of Excellence for skilling to be set up with global expertise and partnerships to equip our youth with the skills required for “Make for India, Make for the World” manufacturing.

Expansion of Capacity in IITs

- Additional infrastructure to be created in the 5 IITs started after 2014 to facilitate education for 6,500 more students.

Centre of Excellence in AI for Education

- A Centre of Excellence in Artificial Intelligence for education to be set up with a total outlay of ₹ 500 crore.

Expansion of medical education

- 10,000 additional seats to be added in medical colleges and hospitals next year, adding to 75000 seats in the next 5 years.

Day Care Cancer Centres in all District Hospitals

- Government to set up Day Care Cancer Centres in all district hospitals in the next 3 years, 200 Centres in 2025-26.

Strengthening urban livelihoods

- A scheme for socio-economic upliftment of urban workers to help them improve their incomes and have sustainable livelihoods announced.

PM SVANidhi

- Scheme to be revamped with enhanced loans from banks, UPI linked credit cards with ₹ 30,000 limit, and capacity building support.

Social Security Scheme for Welfare of Online Platform Workers

- Government to arrange for identity cards, registration on e-Shram portal and healthcare under PM Jan Arogya Yojna, for gig-workers.

- Investing in the Economy

Public Private Partnership in Infrastructure

- Infrastructure-related ministries to come up with a 3-year pipeline of projects in PPP mode, States also encouraged.

Support to States for Infrastructure

- An outlay of ₹1.5 lakh crore proposed for the 50-year interest free loans to states for capital expenditure and incentives for reforms.

Asset Monetization Plan 2025-30

- Second Plan for 2025-30 to plough back capital of ₹ 10 lakh crore in new projects announced.

Jal Jeevan Mission

- Mission to be extended until 2028 with an enhanced total outlay.

Urban Challenge Fund

- An Urban Challenge Fund of ₹ 1 lakh crore announced to implement the proposals for ‘Cities as Growth Hubs’, ‘Creative Redevelopment of Cities’ and ‘Water and Sanitation’, allocation of ₹ 10,000 crore proposed for 2025-26.

Nuclear Energy Mission for Viksit Bharat

- Amendments to the Atomic Energy Act and the Civil Liability for Nuclear Damage Act to be taken up.

- Nuclear Energy Mission for research & development of Small Modular Reactors (SMR) with an outlay of ₹20,000 crore to be set up, 5 indigenously developed SMRs to be operational by 2033.

Shipbuilding

- The Shipbuilding Financial Assistance Policy to be revamped.

- Large ships above a specified size to be included in the infrastructure harmonized master list (HML).

Maritime Development Fund

- A Maritime Development Fund with a corpus of ₹ 25,000 crore to be set up, with up to 49 per cent contribution by the Government, and the balance from ports and private sector.

UDAN – Regional Connectivity Scheme

- A modified UDAN scheme announced to enhance regional connectivity to 120 new destinations and carry 4 crore passengers in the next 10 years.

- Also to support helipads and smaller airports in hilly, aspirational, and North East region districts.

Greenfield Airport in Bihar

- Greenfield airports announced in Bihar, in addition to the expansion of the capacity of Patna airport and a brownfield airport at Bihta.

Western Koshi Canal Project in Mithilanchal

- Financial support for the Western Koshi Canal ERM Project in Bihar.

Mining Sector Reforms

- A policy for recovery of critical minerals from tailings to be brought out.

SWAMIH Fund 2

- A fund of ₹ 15,000 crore aimed at expeditious completion of another 1 lakh dwelling units, with contribution from the Government, banks and private investors announced.

Tourism for employment-led growth

- Top 50 tourist destination sites in the country to be developed in partnership with states through a challenge mode.

- Investing in Innovation

Research, Development and Innovation

- ₹20,000 crore to be allocated to implement private sector driven Research, Development and Innovation initiative announced in the July Budget.

Deep Tech Fund of Funds

- Deep Tech Fund of Funds to be explored to catalyze the next generation startups.

PM Research Fellowship

- 10,000 fellowships for technological research in IITs and IISc with enhanced financial support.

Gene Bank for Crops Germplasm

- 2nd Gene Bank with 10 lakh germplasm lines to be set up for future food and nutritional security.

National Geospatial Mission

- A National Geospatial Mission announced to develop foundational geospatial infrastructure and data.

Gyan Bharatam Mission

- A Gyan Bharatam Mission for survey, documentation and conservation of our manuscript heritage with academic institutions, museums, libraries and private collectors to be undertaken to cover more than 1 crore manuscripts announced.

EXPORTS AS THE 4TH ENGINE OF DEVELOPMENT

Export Promotion Mission

- An Export Promotion Mission, with sectoral and ministerial targets, driven jointly by the Ministries of Commerce, MSME, and Finance to be set up.

BharatTradeNet

- ‘BharatTradeNet’ (BTN) for international trade to be set-up as a unified platform for trade documentation and financing solutions.

National Framework for GCC

- A national framework to be formulated as guidance to states for promoting Global Capability Centres in emerging tier 2 cities.

REFORMS AS FUEL: FINANCIAL SECTOR REFORMS AND DEVELOPMENT

FDI in Insurance Sector

- The FDI limit for the insurance sector to be raised from 74 to 100 per cent, for those companies which invest the entire premium in India.

Credit Enhancement Facility by NaBFID

- NaBFID to set up a ‘Partial Credit Enhancement Facility’ for corporate bonds for infrastructure.

Grameen Credit Score

- Public Sector Banks to develop ‘Grameen Credit Score’ framework to serve the credit needs of SHG members and people in rural areas.

Pension Sector

- A forum for regulatory coordination and development of pension products to be set up.

High Level Committee for Regulatory Reforms

- A High-Level Committee for Regulatory Reforms to be set up for a review of all non-financial sector regulations, certifications, licenses, and permissions.

Investment Friendliness Index of States

- An Investment Friendliness Index of States to be launched in 2025 to further the spirit of competitive cooperative federalism anounced.

Jan Vishwas Bill 2.0

- The Jan Vishwas Bill 2.0 to decriminalize more than 100 provisions in various laws.

PART B

DIRECT TAX

- No personal income tax payable upto income of Rs 12 lakh (i.e. average income of Rs 1 lakh per month other than special rate income such as capital gains) under the new regime.

- This limit will be Rs 12.75 lakh for salaried tax payers, due to standard deduction of Rs 75,000.

- The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment.

- The new Income-Tax Bill to be clear and direct in text so as to make it simple to understand for taxpayers and tax administration, leading to tax certainty and reduced litigation.

- Revenue of about ₹ 1 lakh crore in direct taxes will be forgone.

- Revised tax rate structure

- In the new tax regime, the revised tax rate structure will stand as follows:

| 0-4 lakh rupees | Nil |

| 4-8 lakh rupees | 5 percent |

| 8-12 lakh rupees | 10 percent |

| 12-16 lakh rupees | 15 percent |

| 16-20 lakh rupees | 20 percent |

| 20- 24 lakh rupees | 25 percent |

| Above 24 lakh rupees | 30 percent |

- TDS/TCS rationalization for easing difficulties

- Rationalization of Tax Deduction at Source (TDS) by reducing number of rates and thresholds above which TDS is deducted.

- The limit for tax deduction on interest for senior citizens doubled from the present Rs 50,000 to Rs 1 lakh.

- The annual limit of Rs 2.40 lakh for TDS on rent increased to Rs 6 lakh.

- The threshold to collect tax at source (TCS) on remittances under RBI’s Liberalized Remittance Scheme (LRS) increased from Rs 7 lakh to Rs 10 lakh.

- The provisions of the higher TDS deduction will apply only in non-PAN cases.

- Decriminalization for the cases of delay of payment of TCS up to the due date of filing statement.

- Reducing Compliance Burden

- Reduction of compliance burden for small charitable trusts/institutions by increasing their period of registration from 5 years to 10 years.

- The benefit of claiming the annual value of self-occupied properties as nil will be extended for two such self-occupied properties without any condition.

- Ease of Doing Business

- Introduction of a scheme for determining arm’s length price of international transaction for a block period of three years.

- Expansion of the scope of safe harbour rules to reduce litigation and provide certainty in international taxation.

- Exemption of withdrawals made from National Savings Scheme (NSS) by individuals on or after the 29th of August, 2024.

- Similar treatment to NPS Vatsalya accounts as is available to normal NPS accounts, subject to overall limits.

- Employment and Investment

Tax certainty for electronics manufacturing Schemes

- Presumptive taxation regime for non-residents who provide services to a resident company that is establishing or operating an electronics manufacturing facility.

- Introduction of a safe harbour for tax certainty for non-residents who store components for supply to specified electronics manufacturing units.

Tonnage Tax Scheme for Inland Vessels

The benefits of existing tonnage tax scheme to be extended to inland vessels registered under the Indian Vessels Act, 2021 to promote inland water transport in the country.

- Extension for incorporation of Start-Ups

Extension of the period of incorporation by 5 years to allow the benefit available to start-ups incorporated before 1.4.2030.

- Alternate Investment Funds (AIFs)

Certainty of taxation on the gains from securities to Category I and Category II AIFs which are undertaking investments in infrastructure and other such sectors.

- Extension of investment date for Sovereign and Pension Funds

Extension of the date of making investments in Sovereign Wealth Funds and Pension Funds by five more years, to 31st March, 2030, to promote funding from them to the infrastructure sector.

INDIRECT TAX

Rationalisation of Customs Tariff Structure for Industrial Goods

Union Budget 2025-26 proposes to:

- Remove seven tariff rates. This is over and above the seven tariff rates removed in 2023-24 budget. After this, there will be only eight remaining tariff rates including ‘zero’ rate.

- Apply appropriate cess to broadly maintain effective duty incidence except on a few items, where such incidence will reduce marginally.

- Levy not more than one cess or surcharge. Therefore Social Welfare Surcharge on 82 tariff lines that are subject to a cess, exempted.

Revenue of about ₹ 2600 crore in indirect taxes will be forgone.

Relief on import of Drugs/Medicines

- 36 lifesaving drugs and medicines fully exempted from Basic Customs Duty (BCD).

- 6 lifesaving medicines to attract concessional customs duty of 5%.

- Specified drugs and medicines under Patient Assistance Programmes run by pharmaceutical companies fully exempted from BCD; 37 more medicines added along with 13 new patient assistance programmes.

Support to Domestic Manufacturing and Value addition

- Critical Minerals :

- Cobalt powder and waste, the scrap of lithium-ion battery, Lead, Zinc and 12 more critical minerals fully exempted from BCD.

- Textiles:

- Two more types of shuttle-less looms fully exempted textile machinery.

- BCD rate on knitted fabrics revised from “10% or 20%” to “20% or ` 115 per kg, whichever is higher.

- Electronic Goods:

- BCD on Interactive Flat Panel Display (IFPD) increased from 10% to 20% .

- BCD reduced to 5% on Open Cell and other components.

- BCD on parts of Open Cells exempted.

- Lithium Ion Battery:

- 35 additional capital goods for EV battery manufacturing, and 28 additional capital goods for mobile phone battery manufacturing exempted.

- Shipping Sector:

- Exemption of BCD on raw materials, components, consumables or parts for the manufacture of ships extended for another ten years.

- The same dispensation to continue for ship breaking.

- Telecommunication:

- BCD reduced from 20% to 10% on Carrier Grade ethernet switches.

Export Promotion

- Handicraft Goods:

- Time period for export extended from six months to one year, further extendable by another three months, if required.

- Nine items added to list of duty-free inputs.

- Leather sector:

- BCD on Wet Blue leather fully exempted.

- Crust leather exempted from 20% export duty.

- Marine products:

- BCD reduced from 30% to 5% on Frozen Fish Paste (Surimi) for manufacture and export of its analogue products.

- BCD reduced from 15% to 5% on fish hydrolysate for manufacture of fish and shrimp feeds.

- Domestic MROs for Railway Goods:

- Railways MROs to benefit similar to the aircraft and ships MROs in terms of import of repair items.

- Time limit extended for export of such items from 6 months to one year and made further extendable by one year.

Trade facilitation

- Time limit for Provisional Assessment:

- For finalising the provisional assessment, time-limit of two years fixed, extendable by a year.

- Voluntary Compliance:

- A new provision introduced to enable importers or exporters, after clearance of goods, to voluntarily declare material facts and pay duty with interest but without penalty.

- Extended Time for End Use:

- Time limit for the end-use of imported inputs in the relevant rules extended from six months to one year.

- Such importers to file only quarterly statements instead of a monthly statement.