- Knight Frank Prime Ski Property Index rises 1.4% YoY in Q2 2019

- Val d’Isere in France takes the pole position

- All six top rankings are occupied by French resorts this year

- Wealthy Indians residing in London and Dubai favour French Alps, mainly Courchevel and Megeve

Mumbai, November 27, 2019: Leading international property consultant Knight Frank in its latest Prime Ski Property Report has revealed that ski homes in the Alps have witnessed an average price growth of 19% over the last decade, outperforming average returns from prime properties in tier-I cities like Geneva (19%), Mumbai (13%), Monaco (-11%) and St. Tropez (-22%).

Knight Frank’s unique Prime Ski Property Index, which provides an overview of prime market conditions and tracks the price of a four-bedroom chalet in a central location across key resorts in ski destinations in the French Alps and Swiss Alps, has increased by 1.4% YoY in Q2 2019. The index was established in 2008.

How do ski homes in the Alps as an asset class compare with other prime property markets?

| Market | Price appreciation in last 10 years |

| London | 47% |

| Paris | 47% |

| Moscow | 24% |

| New York | 21% |

| Alpine Property – Average | 19% |

| Geneva | 19% |

| Mumbai | 13% |

| Dublin | -1% |

| Dubai | -10% |

| Monaco | -11% |

| St. Tropez | -22% |

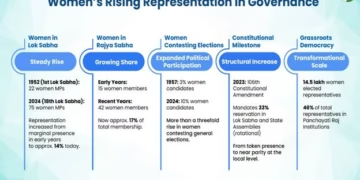

Val d’Isere in France leads the Prime Ski Property Index, with an annual price growth of 2.9% in the year to June 2019, followed by Chamonix (2.6%) and Saint-Martin-de-Belleville (2.4%)at the second and third positions.Easy accessibility, low mortgage rates, hassle-free rental, stable or rising prices, market liquidity to facilitate their future exit strategy, and currency advantage are the major factors facilitating growth.

Wealthy Indians from London and Dubai target the premium luxury markets in the Alps, favouring Courchevel and Megeve, for the quality of the restaurants and shops on offer as well as the seamless and excellent service in these resorts. Courchevel 1850 saw a price rise of 1.8% YoY in Q2 2019 with a price of Euro 26,000 per sq m. Price remained constant for Megeve at Euro 13,700 per sq m.

In terms of the investment class, KF Prime Ski Prime Index (1.4%) performed better than Furniture, which gave 1% YoY return in Q2 2019, Cars (-5%) and Jewellery (-7%).

French resorts have widened their lead over their Swiss counterparts, with all six top rankings being occupied by French resorts this year, which were mostly located in The Three Valleys. A remarkable trend seen for the first time this year is that none of the ski resorts tracked in Knight Frank’s index registered a decline in prime prices.

Shishir Baijal, Chairman & Managing Director, Knight Frank India, said, “As a lifestyle asset, the purchase of a ski home is often an emotive decision, but investment rationale is becoming more compelling. With prime ski homes offering capital value comparative to prime residential properties of global cities, Alpine investment is a lucrative asset class for Indians looking to diversify the portfolio and invest in a safe currency from a long term outlook.”

According to Knight Frank Wealth Report 2019, a total of 18% of wealthy Indians were looking to emigrate to another country permanently. Out of the total, 3% are looking to shift to Switzerland and the same percentage to France; formulating a latent demand for prime residential properties, including Ski resorts.

Where are Wealthy Indians planning to emigrate?

| Locations | % of Indian Ultra High Net–worth Individuals looking to emigrate |

| Argentina | 6% |

| Australia | 21% |

| Canada | 21% |

| France | 3% |

| Luxembourg | 3% |

| Monaco | 3% |

| Switzerland | 3% |

| Singapore | 26% |

| UK | 74% |

| US | 53% |

| UAE | 29% |

Source: Knight Frank Wealth Report 2019